Silo Finance 2024 Roadmap

This year we aim to grow Silo Finance into the leading lending protocol with the release of multiple intertwined protocols, including Silo v2 lending that enables the deployment of permissionless, immutable, extensible, ERC-4626 compatible, and customizable two-asset lending markets.

Outline

In this post, we lay out an aggressive growth strategy that consists of several proposals on which SiloDAO needs to vote before implementation:

- Releasing Silo v2 lending markets

- Moving governance to the veSILO framework

- Burning 300M SILO tokens

- Implementing a multi-year emission program

- Expanding into new ecosystems

- Releasing Silo Liquidity Vaults

Lending markets

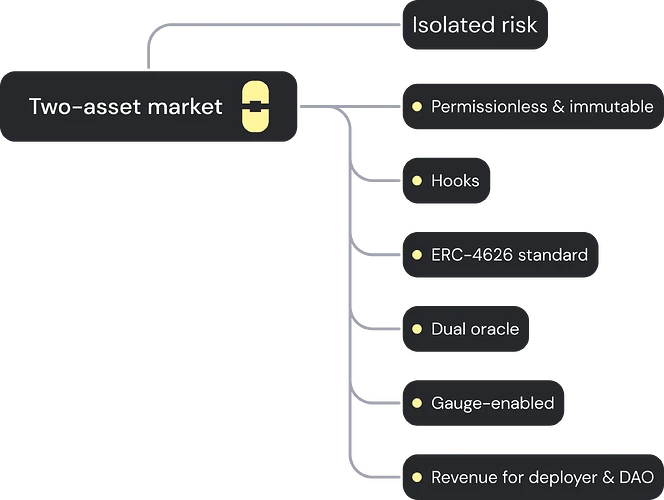

Below are some of the most essential features packed into every Silo v2 lending market:

Permissionless & Immutable: Deploy two-asset lending markets for ERC-20 tokens with custom LTV/LT factors, oracles, interest rate curves, and more.

Hooks: Silo v2’s optional hooks expand the capability of lending markets at the market level, opening the door for new capabilities in lending, such as:

- Enabling guardians to take emergency actions under certain conditions

- Implementing supply and borrow caps

- Deploying managed lending markets

- Deploying permissioned markets that limit participation to KYC’d users

- Using Oracle callbacks to protect markets from read-reentrancy threats

- Implementing self-incentivizing mechanisms

- Distributing third-party rewards to users

Modular liquidations: Each market can implement any liquidation solution, from traditional Compound-style to auction-based to soft liquidations.

Modular interest rate models: From fixed-rate to dynamic to kinked-interest, interest rate models are another module in Silo v2 design that enables deployers to choose any interest rate model that suits the market’s underlying assets: stablecoins, long tail assets, high liquidity assets, real-world assets, etc. To help deployers deploy markets faster, we will provide a library of interest models upon deploying v2 markets.

Dual-oracle: Deployers choose different oracles to calculate Loan-To-Value (LTV) and Liquidation Threshold (LT) factors, reducing the risk of bad debt when oracles with shorter time-weighted windows are used to enforce the liquidation threshold.

Easy integrations: Silo v2 lending markets use the ERC-4626 standard, enabling third parties to easily and permissionlessly integrate with our lending markets.

Gauge-enabled markets: Any market can receive incentives internally from SiloDAO or externally from 3rd-parties. Incentives can be directed to any action in any market, including borrowing an asset. Receiving incentives is passive and does not require staking receipt tokens.

Deployer revenue: Optionally set, the deployer revenue is a fee levied on interests and incentives generated in the money market that accrue to the deployer perpetually. The SiloDAO sets a universal maximum deployer fee. The deployer’s revenue incentivizes deploying custom money markets that need significant development resources. The deployer revenue is tokenized into an ERC-721 token that can be transferred or sold.

DAO revenue: SiloDAO receives a cut of interest and, optionally, a cut of incentives generated in all markets.

veSILO governance

We propose implementing veSILO to replace SiloDAO’s current governor.

How does veSILO governance work?

veSILO, a non-transferrable ERC-20 token, enables the governance framework. Users mint veSILO by depositing 80% SILO and 20% WETH into a Balancer pool and then locking the LP token for any duration ranging from 2 weeks to 3 years, with longer locks receiving larger amounts of veSILO.

veSILO utility

- Boost your yield when lending/borrowing in Silo’s lending markets on any chain.

- Receive emissions from Silo’s incentive program.

- Receive a share of SiloDAO’s revenues if the DAO chooses to turn revenue-sharing on.

- Vote on $SILO emissions to lending markets cross-chain.

- Create proposals such as deploying gauges.

Cross-chain governance

veSILO governance works cross-chain between Mainnet and L2s, as well as between L2s. Using Chainlink CCIP, veSILO holders on one chain benefit from a boost in incentives if they lend/borrow on other L2s. SILO holders will also be able to transfer their tokens instantly using a CCIP bridge.

A proposal to move veSILO governance to L2

veSILO brings numerous benefits to its holders. However, we recognize that if we kept the governance of Silo v2 on Ethereum Mainnet, many users may not be able to realize these benefits due to high gas costs. For example, if SiloDAO decides to share revenue with veSILO holders, repeatedly claiming these rewards may be expensive, as would voting regularly on distributing SILO incentives to markets (i.e., gauge weight voting).

For those reasons, SiloDAO should consider deploying veSILO governance onto one of the major layer two chains. The process would involve minting a new SILO token to replace the current one. We plan to create a governance topic to gauge the community’s feelings and decide on the next steps.

Long-Term Emission Program

The SiloDAO has been vesting around 450M SILO tokens since November 30, 2021 and ending on November 30, 2024. We propose allocating 30% of the total token supply (~300M SILO tokens) to incentivize the use of Silo v2 money markets via the veSILO gauge voting system. To do that, we will need to burn 30% of the token supply and then mint the same amount every block for the duration of the program, which is set to ~20 years.

Published here, notice two emission streams in the proposed emission program:

- Stream one: SILO emissions streaming every block to Silo v2 markets. The emission distribution is determined using the veSILO gauge system, in which veSILO holders vote weekly on allocation weights for proposed markets.

- Stream two: SILO emissions streaming every block to veSILO holders. The incentives serve as a base APR for holding veSILO.

A summary of the SILO community incentive program:

- Multi-chain: Incentive streaming to Silo v2 markets anywhere they are deployed

- Allocation: ~300M tokens; 30% of total supply

- Duration: 20+ years

- Admin control: SiloDAO

- Emissions control: Gauge system receives allocations as voted by veSILO holders

Silo Liquidity Vaults

We have designed a new vault layer to quickly improve liquidity in response to growing borrowing demand. A vault is a single-asset contract that can deploy liquidity to several markets at a time and distribute interest and rewards to all its depositors in a yield-aware and gas-efficient manner.

A brief list of features:

- Algorithmic: Optimized liquidity distribution among connected markets to maximize yield using an on-chain algorithm.

- Zero fees: Depositors keep all interest and incentives generated by the vault. This does not count the fee on the vault’s underlying markets that the DAO may switch on.

- veSILO compatible: Depositors in a vault retain a veSILO boost similar to depositing directly in a market.

Protocol release plan

SiloDAO will vote on releasing three separate tightly integrated protocols: Silo v2 lending markets, veSILO governance, and Silo liquidity vaults.

The following is a tentative release plan:

- Trail of Bits audit — completed for core contracts and veSILO;

- Internal formal verification — concluding soon for core contracts and veSILO;

- Certora audit & formal verification — ongoing for core contracts and veSILO;

- Community audit and formal verification contest;

- Deploy Silo v2 smart contracts under Business Source License 1.1;

- Deploy veSILO governance;

- Deploy Silo Vaults.

2024 growth and marketing strategy

Here is a sneak peek of what will unfold in 2024:

- Deploy Silo v2 on multiple Layer 2s;

- Run large-scale PR and marketing campaigns;

- Make SILO accessible to as many users as possible by listing on the most popular centralized exchanges;

- Expand integrations with dApps, asset issuers, asset managers, and other entities collectively controlling or influencing tens of billions of dollars of crypto assets.

One last word

We extend our gratitude to everyone who has supported our community from the initiation to this exciting moment, from community members who have shown their faith in our DAO to the core contributors of projects that have believed in us and invested time integrating with our markets, and last but not least to the ecosystems that have supported us. We promise to continue to innovate and work tirelessly to advance DeFi.