Our Journey and Recent Success

Three years ago, we set out to revolutionize DeFi lending by creating risk-isolated money markets for all token assets. Today, Silo has evolved into a cornerstone of risk-isolated lending in the DeFi ecosystem.

Our latest product, Silo v2, takes lending to new heights with immutable, customizable markets that offer the industry’s lowest liquidation fees. What sets Silo v2 apart is its ability to deploy lending markets embedded with features that can truly push lending to new frontiers - by using Hooks. The success of Silo Sonic demonstrates this potential – in just one month, we’ve attracted thousands of users, secured over $400M in Total Value Locked (TVL), and facilitated more than $200M in active loans. Even more exciting is how other dApps in the Sonic ecosystem have integrated with our v2 markets, leveraging our straightforward, standardized markets.

Preparing to Scale

We’ve set an ambitious goal: achieving $1 billion in loans by the end of 2025. This target reflects our team’s competitive spirit and the unwavering dedication of both our core team and SiloDAO members.

We’re completing two comprehensive security audits of the Silo v2 core protocol with Sigma Prime and Spearbit Cantina. We’re pleased to report that no critical issues have been identified, and we’ll publish the full audit reports by the end of February 2025.

This security milestone enables us to:

- Expand Silo Sonic to new heights

- Develop markets with custom hooks for optimizing yield and capital efficiency

- Attract substantial liquidity from major funds and yield optimization platforms

- Deploy Silo v2 across new blockchain networks

Introducing Silo Vaults

We’re finalizing our new liquidity layer, Silo Vaults, which will operate on top of Silo v2 markets. These permissionless, single-token vaults will be managed by external teams, offering users new opportunities while maintaining transparency about trust delegation to vault managers.

New Incentive Programs

To support the growth of Silo v2 and Silo Vaults, we’re proposing three $SILO incentive programs for the next twelve months:

- Vault Manager Incentive Program (72M $SILO)

- Cumulative rewards, granted based on TVL or Revenue metrics

- Performance measured using 60-day medians

- Quarterly distributions with one-year linear vesting

- One-year program or until all 72M SILO tokens granted

| Total Value Locked | DAO Revenue (Annualized) | Cumulative Grant ($SILO) |

|---|---|---|

| $3,125,000 | $9,141 | 357,143 |

| $6,250,000 | $18,281 | 714,286 |

| $12,500,000 | $36,563 | 1,428,571 |

| $18,750,000 | $54,844 | 2,142,857 |

| $25,000,000 | $73,125 | 2,857,143 |

| $31,250,000 | $91,406 | 3,571,429 |

| $37,500,000 | $109,688 | 4,285,714 |

| $50,000,000 | $146,250 | 5,714,286 |

| $62,500,000 | $182,813 | 7,142,857 |

| $93,750,000 | $274,219 | 10,714,286 |

| $125,000,000 | $365,625 | 14,285,714 |

| $156,250,000 | $457,031 | 17,857,143 |

| $187,500,000 | $548,438 | 21,428,571 |

| $250,000,000 | $731,250 | 28,571,429 |

| $312,500,000 | $914,063 | 35,714,286 |

| $625,000,000 | $1,828,125 | 71,428,571 |

- User Incentive Program (40M $SILO)

- Rewards distributed through Silo v2 gauges

- Structured campaigns with predetermined allocation formulas

- Partner Incentive Program (13M $SILO)

- Strategic allocations to attract high-value partners and integrations

Enhanced User Experience

Our new interface is about to drop, and it’s a game-changer - bringing together Silo v2 lending markets and Silo Vaults in one smooth, multi-chain experience. This isn’t just a facelift - it’s the first step in making Silo incredibly user-friendly.

You’ll notice some major upgrades:

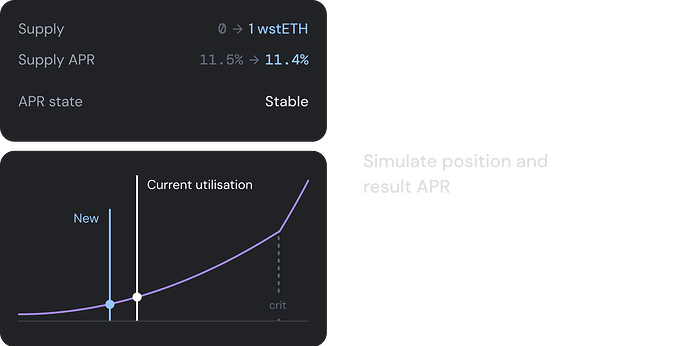

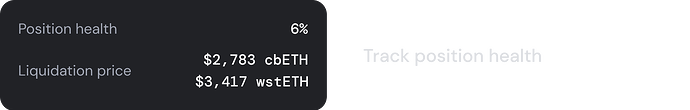

- Super intuitive Lend/Borrow experience

- Advanced filters to help you find spot opportunities easily and fast across all Silo deployments

- Profit tracking so you always know where you stand

And here’s the exciting part - we’re launching Silo Strategies, giving you one-click access to leverage strategies that can seriously amp up your yields. Stay tuned for more details on this one - it’s going to be huge.

Scroll down to take a quick look at the updated UI.

Discontinuing Revenue Sharing

While we’ve distributed approximately 166 ETH to token holders over the past four months, we’re discontinuing the program for the next three months. This isn’t about reducing value for token holders; it’s about supercharging Silo’s growth.

Let me share why we’re pumped about this direction:

- Doubling down on innovation: We’re going all-in on building cool stuff with Silo v2 hooks. Yes, it means expanding the team, putting serious resources into development, and spending more on security audits, but we believe this investment will grow DAO’s revenue significantly.

- Accelerating growth: We’re stepping up our presence in a big way. Beyond just regular marketing, we’re rolling out some exciting PR campaigns and partnering with key opinion leaders (KOLs) who really get what we’re building. Plus, we’ve got our sights set on some major exchange listings that should put $SILO in front of a much bigger audience. These initiatives require significant budgets.

But here’s the exciting part: We’re planning to propose revenue sharing in a sustainable way veSILO in June 2025!

New UI - screenshots

We welcome your feedback on these initiatives as we continue to build the future of DeFi lending together.